Close the gap in

Ultra-high-net-worth planning

Operating Margins are Better in Wealth Management Firms

If you want to know how to create a wealth-management model firm, register to receive this free, 30-minute, on-demand webinar.

Join us for a FREE Webinar

CPA Models for Wealth Management

CPAs Should be their clients' most trusted Advisor.

Are you?

CPAs Are Attracted to Wealth Management as a Service and They Are Right

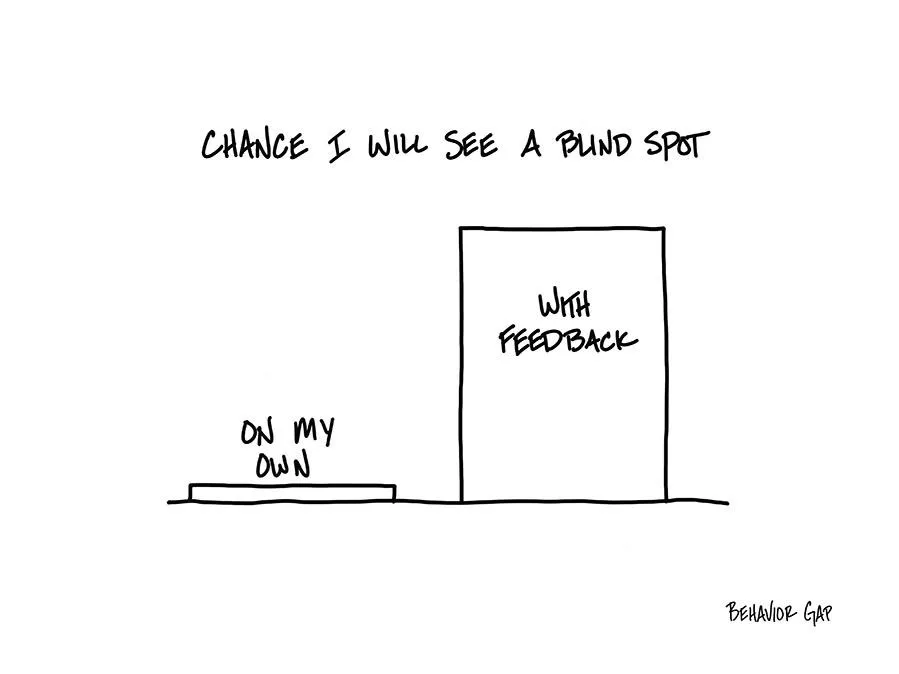

Clients rely on CPAs for critical tax and business advice. That positions a CPA to become the trusted go to advisor-even if many CPAs don’t create the operational model to establish themselves as the top trusted advisor. But if the CPA does realize the potential here, the opportunity to play a role on the wealth management side becomes logical.

Discover how accessing a deep team of outstanding independent experts

can help you deliver solutions in critical niches

of tax planning, estate planning, wealth management - and more.

— Peter Gellman

Palmerston Group

Peter Gellman is the Managing Member of Palmerston Group Advisors, L.L.C. Founded in 1997, Palmerston Group provides independent, unbiased financial and investment advisory services based on fundamental analysis and margin of safety principles.

Peter Gellman has worked as a teacher, analyst, and advisor. Before starting Palmerston, he taught at Oxford as a member of its international relations faculty, as well as at Princeton, where he was Research Fellow and Lecturer in the Woodrow Wilson School of Public and International Affairs. He holds a law degree as well as a Ph.D. in international relations.

— Christopher Barchetto

CPA - Smolin Advisory

With more than 25 years of experience, Christopher Barchetto specializes in providing

tax and accounting/consulting services

to contractors, including general contractors and subcontractors in all segments of the industry. He has extensive experience in providing audits, reviews, compilations, and agreed-upon procedure engagements. Chris also has extensive experience in tax return preparation for corporations, partnerships, and individuals.

— Joe Pasquino

CPA - Smolin Advisory

Joseph Pasquino has been practicing public accounting for over 10 years.

Joe's clients include high net worth individuals and closely held businesses, where he focuses on their tax, accounting and consulting needs. He services clients in various types of businesses, including the Medical, Legal, Information Technology, and Real Estate industries. In addition, Joe provides highly personalized services to our clients in Smolin's Premier Lifestyle Services group and works closely with our approved panel of experts through Smolin Wealth Advisors.

Unlock Your Path to Solving the Wealth Management Problem and Ending Retention Risk for Your Top Clients.

Register now and hear how other CPA's Closing the Gap in High-Net-Worth Financial Planning

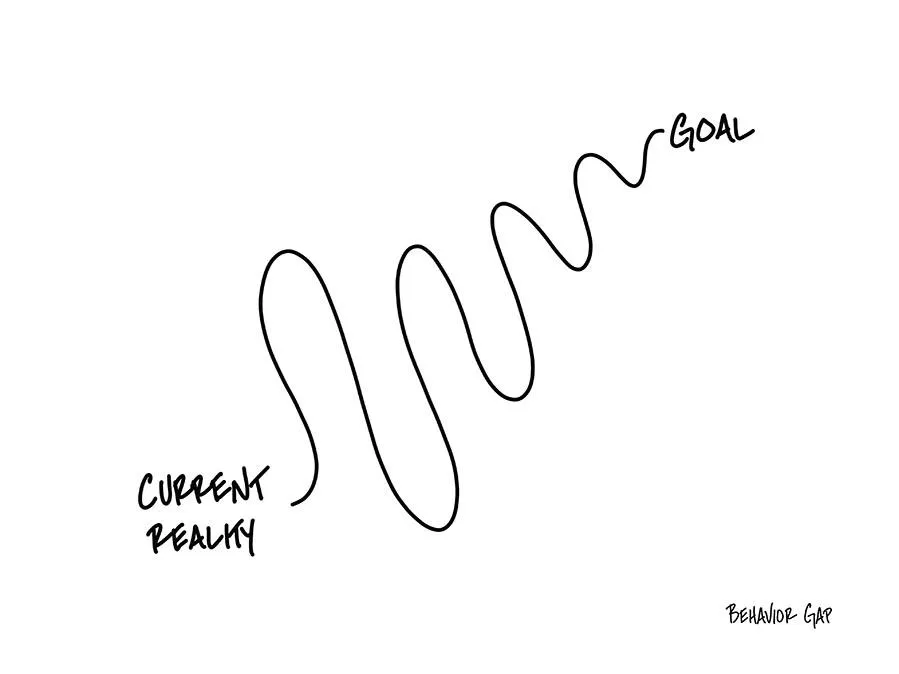

A CPA’s top clients typically and regularly break through to the next level of success. And with each level of success comes:

Greater income and tax exposure

Larger estates to protect

More key employees to nurture and incentivize

More and more financial and business issues which require a fresh comprehensive planning review

CPA Trust Unlimited is a service of Palmerston Group Advisors. It uses Palmerston’s “Team of Experts Planning” approach to free CPAs to focus on their best clients. We have done extensive work to create a deep team of outstanding independent experts who cover critical niches of the tax code. We deliver that team’s comprehensive knowledge directly to the CPA while significantly freeing up the CPA’s time. The CPA retains control throughout; ideally, the relationship with the client should never leave the CPA’s hands.

Schedule a Call

If you can find 15 minutes, we can show you how to offer wealth management services.

Let us know when you're available by selecting your appointment time.

Or - send an email to [email protected] and we will reach out to schedule with you.